How Generative AI Revolutionizes the Insurance Industry

Generative Artificial Intelligence (AI) has become an increasingly powerful tool in the insurance industry, offering a revolutionary change from traditional underwriting, selling, and servicing methods. With its ability to generate new and valuable information quickly and accurately, AI can substantially improve customer experience and significantly reduce losses on written premiums (loss ratios) and expenses related to underwriting and servicing (expense ratios).

Machine learning is at the heart of generative AI, allowing for a more accurate interpretation of large amounts of data. By leveraging this technology, insurers can gain deeper insight into their customers’ preferences and behaviors, better-predicting risk levels, and effectively personalize services in real time. While generative AI is still in the early stages of development, it can potentially transform the insurance value chain and create more company value.

The Scope of Digital Transformation in the Insurance Value Chain

Industries have access to vast amounts of data that can provide valuable insights and enhance productivity. Artificial Intelligence can harness this data and influence precise decision-making and customer satisfaction. With generative AI and the arrival of emerging technologies like computer vision and ChatGPT, this trend is also evident in the industry.

From automating customer onboarding to streamlining processes like underwriting and claims management, artificial intelligence allows insurers to leapfrog over their counterparts, innovate, and set the stage for intelligent insurance. AI-driven predictive analytics are also invaluable in helping insurers assess risk levels and devise more accurate assessments. Let’s discuss how it affects the Insurance Value Chain.

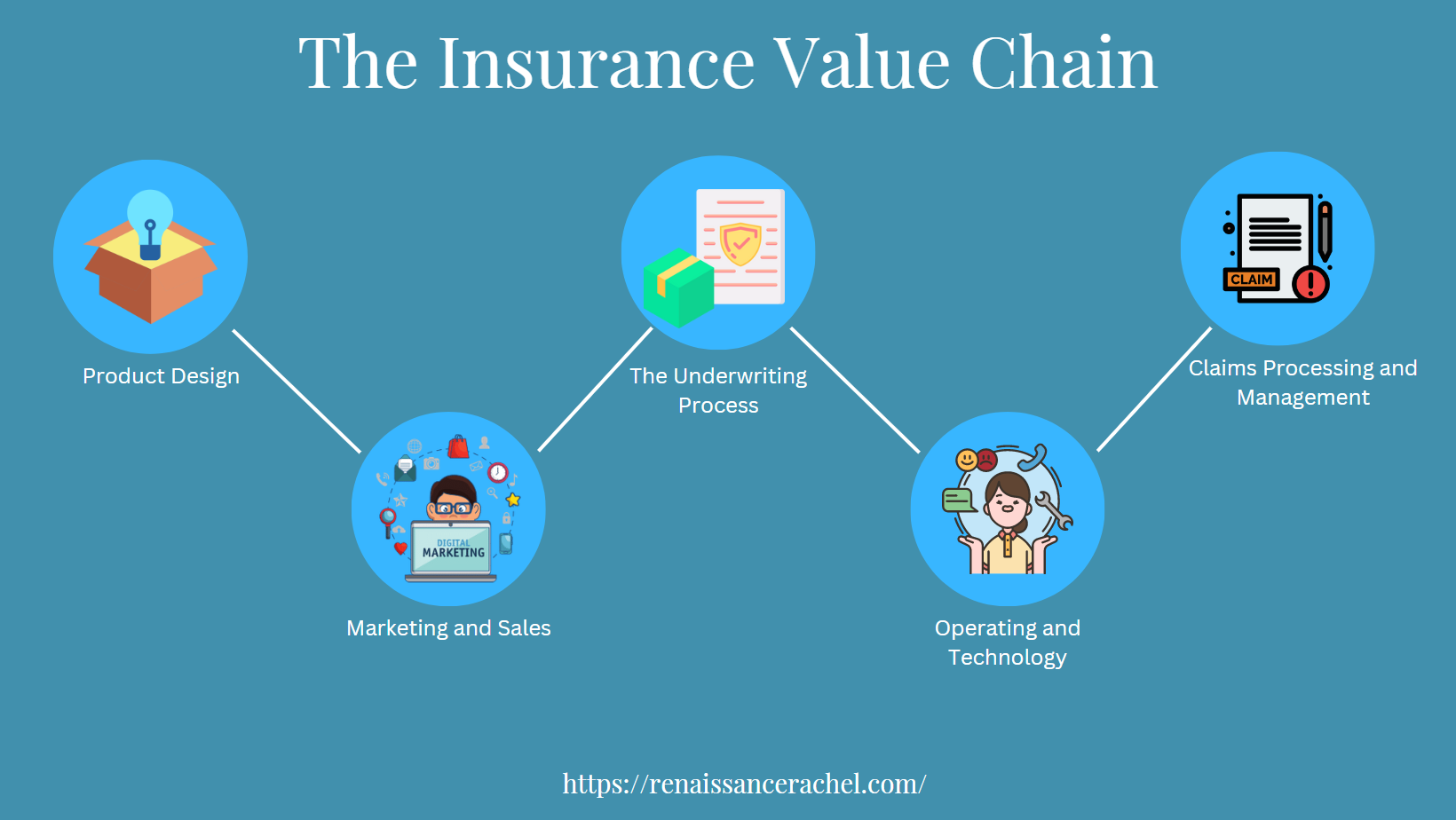

What is the Insurance Value Chain?

If you work in insurance, you already know the Insurance Value Chain. The concept comprises critical functions that form a unified approach to optimizing an insurer’s performance. To put it another way, it’s how the industry manages its operations.

It consists of five distinct stages:

1. Product Design

2. Marketing and Sales

3. The Underwriting Process

4. Operations and Technology

5. Claims Processing and Management

Generative AI can leverage Machine Learning (ML) algorithms to process large amounts of data. AI can produce more accurate predictions, providing more tailored services for customers.

Product Design

Insurance companies used to separate themselves from competitors by developing new products, but in recent years, digital-only startups backed by private funds have gained a substantial market share. These startups excel in offering highly customizable policies. The lack of competition due to regulations limits innovation in public carriers and smaller firms.

As a result, many have redirected their focus and started selling to private startups instead of trying to compete in the arena. Insurance companies that want to gain a competitive edge in product development can combine customer feedback, risk assessment, sales, and more data and find new ways to differentiate themselves.

Marketing and Sales

Insurance companies relying solely on captive agents discover this distribution method is less effective. Nationwide, one of the largest carriers in the country, finished a transition in the summer of 2020. As a result, their captive agents were released and became fully independent.

Nationwide recognized that its clients sought the option only independent agents could offer. One reason is that digital insurance platforms provide more options and are easier to use. Insurers operating on captive distribution can recapture the edge over their competition by:

- Shifting the focus to independent agents.

- Investing in digital transformation products.

Underwriting Process

Underwriting is the cornerstone of the insurance industry, and it has been largely unchanged for decades. It consists of gathering information, analyzing data to assess risk levels, and deciding whether to provide coverage. Traditionally this involved manual labor and paperwork that took too long, but AI puts them in an excellent position to automate.

AI uses a data strategy to analyze large amounts of data quickly and accurately, enabling insurers to make informed decisions in a fraction of the time. AI-driven predictive analytics can also reduce underwriting costs by identifying potential risks before they become costly claims.

Operations and Technology

Insurers increasingly use AI and Natural Language Processing (NLP) to reduce costs and streamline processes. Several operational efficiency and technology challenges create incompatibility issues between legacy software and new cloud platforms. This forces third-party IT companies to make unrealistic promises.

Some companies may need to recruit data scientists and specialists to work in-house to improve their insurance products. Others may need to focus on balancing AI and human involvement to serve customers better and solve claims problems.

Claims Processing and Management

Processing insurance claims is a highly complex aspect of the value chain that affects the customer experience. By leveraging AI for claims processing, insurers can significantly reduce the time it takes to process claims. AI-driven solutions can also automate manual tasks such as documentation and case management and reduce errors.

This not only saves insurers time and money but also allows them to provide enhanced customer service through faster response times. Sure, claims professionals would need some proficiency in data analysis and AI to understand how the tool works, but this would also open up new opportunities for customer service.

What is the Market Size for the Global Generative AI Market?

It’s easy to speculate just how far generative AI could take insurance, but the more important question is what kind of impact it could have. According to a Research and Markets industry forecast, the global generative AI market size is expected to increase significantly over the next few years. As of 2021, the market was valued at USD 7.6 billion. It’s expected to grow from USD 10.16 billion in 2022 to USD 103.74 billion by 2030.

The increasing use of technologies and the need to update workflow will continue to drive the demand for generative AI applications in a society where human interaction with technology plays an integrated role.

Uses Cases for AI in Insurance

AI will become more valuable to insurance companies as the world becomes more digitalized. Throughout the five pillars of the value chain, AI will be an invaluable tool for insurers seeking a competitive edge.

- Insurers can use generative AI to evaluate risk, identify fraudulent claims, and minimize mistakes made during the application process. This enables insurers to offer customers the ideal plans that match their needs.

- It has been suggested by some insurance providers that the use of machine learning may eventually eliminate human underwriters. However, this isn’t expected to occur.

Here are a few popular technology strategies insurance companies can use.

Written Content Creation

Generative AI tools can create written content, such as text summaries and reports for customer service agents or underwriters. This can help reduce the time it takes to process a claim and improve customer service by providing personalized responses. Or agents could quickly send drafts of customer policies using insurance-trained AI models.

AI Chatbot Improvements

Insurers can also use AI chatbots to give real-time answers, advice and increase customer engagement. AI chatbots can improve customer retention and acquisition by providing an interactive customer experience. AI chatbots can detect fraudulent activities or anomalies in customer data assets, which reduces losses from fraud and theft.

Insurance Software Coding

AI can also be used to write code for insurance applications and software. AI coding websites are already used to automate specific processes, such as creating small business ideas and risk calculations. This can significantly reduce the time and effort to develop new insurance products. Generative AI models may already be able to create legitimate business ideas and generate a viral product idea simply from training on existing products.

Empowered Contact Center Agents

Agents can utilize high-quality data from advanced analytics to summarize and gain insights into customer interactions, allowing them to measure sentiment in real-time. This helps staff receive immediate coaching and improve their responses to future inquiries. Additionally, insurers can use connected devices to compile insights to enhance the overall customer experience.

How Artificial Intelligence is Reshaping the Value Chain and the Industry

It’s easy to see how generative AI can reshape the industry. From underwriting to customer service, AI solutions create efficient workflows and offer insightful data to improve processes. Yet, “out of of the box” generative AI can:

Improve Operations

Generative AI technology is transforming insurance with new technologies. AI enables claims and loss handling to become more efficient, with improved accuracy and reduced administrative costs. Using AI applications also streamlines fraud detection systems.

Enhance Customer Service

Additionally, generative AI has optimized customer service, allowing for faster response times and better customer satisfaction. Insurers are using products to automate underwriting processes and improve customer service. A recent Forrester report shows how companies can stay “customer-obsessed” by joining the generative AI revolution.

Use Machine Learning to Improve Risk Assessments

The impact of generative AI will be felt across countless industries. This will involve integrating machine learning techniques into crucial processes to enhance functionality.

- Risk mitigation – The analyzing capability of generative AI helps provide a broader and deeper view of data improving pattern recognition and identifying potential risks to the enterprise more quickly.

- Sustainability – Using AI can assist enterprises in adhering to sustainability regulations, minimizing the chance of stranded assets, and integrating sustainability into the work.

Applying generative AI to insurance will transform the industry and induce significant changes with specific benefits.

Benefits of Generative AI in the Insurance Industry

Understanding the insurance value chain is crucial to achieving company-wide optimization. Generative AI tackles the inefficiencies of the insurance industry by:

Creating Superior Insurance Recommendations Using Customer Insights

Insurers use AI in the insurance industry to develop a data engine that guides sales agents on which elements of the customer journey work best for different campaigns. This engine is utilized across multiple channels – email, SMS, and banners – to personalize content. This automated process allows sales agents to devote more time to growth-focused initiatives by replacing time-consuming manual tasks.

Accomplishing More With Big Data

Generative AI collects extensive data and trains on foundation models (FMs) to develop new solutions without much human intervention and with greater accuracy. This takes place on a large scale, enabling companies to extract more from complex and unstructured data sources and gain new insights. There are also AI solutions that facilitate better data security and will protect customer information from security breaches.

Improving Fraudulent Claims and Detection

Machine learning advancements have removed entry barriers, allowing companies to leverage generative AI solutions for insurance to enhance detection. Deeply integrated AI algorithms have the potential to detect inconsistencies in claim reports and provide real-time alerts for agents to investigate suspected fraud.

Generative AI can also provide predictive analytics by noting accident patterns, fraudulent behavior, or warning signs, permitting insurers to preempt potential losses in the near future. Using generative AI in these areas will improve the accuracy of detection and processing of claims and reduce costly errors and claims getting delayed or rejected.

Increasing Revenue for the Insurance Industry

Generative AI is revolutionizing the insurance industry by providing new opportunities for insurers to create new revenue streams. For example, predictive modeling can improve risk assessment and provide more accurate pricing models for customers. Generative AI also opens new opportunities for insurers to create personalized product offerings based on unique lifestyle traits and customer insights.

Risks of AI in the Insurance Business

Knowing the potential costs and risks of using generative AI, even for legitimate purposes, is important because it can produce inaccurate results. To reduce these risks, the insurer should approach the results with professional skepticism and prioritize quality assurance when interpreting them.

Lack of Transparency Due to the “Black Box”

Generative AI algorithms are typically “black box” systems, meaning they work on complex models and are difficult to comprehend. The system’s black-box function prevents the user from understanding how it provides its output.

Social, Ethical, and Legal Biases Built in the AI Model

To ensure fairness, models must adhere to regulations and avoid bias or discrimination. It’s essential to have transparency and clear reasons for decisions made by ML/AI systems to build trust. However, it’s difficult to detect defects and biases in opaque systems, making it challenging to implement safeguards.

Inaccuracies Affecting the Insurer’s Historical Data on Customers

AI models are trained on historical data gathered from the past. If this data is inaccurate, it can lead to wrong decisions and incorrect results output by the model. Insurers need to be aware of this and take steps to minimize errors in historical data.

Security Risks With AI Tools

There is a growing concern regarding the inappropriate utilization of data, with massive amounts of reports of third parties mishandling sensitive information. Customers are becoming more vocal about their demand for privacy and security measures. According to industry professionals, integrating AI insurance is a viable solution to address this issue.

Lack of Customer Confidence Due to the Opacity AI Technologies

When a claim is denied, customers expect an explanation. However, providing an adequate reason for denials is challenging with opaque models. The lack of accountability, auditing, and engagement reduces opportunities for human understanding. Additionally, developers and users aren’t familiar with the processing system, intensifying the bias in datasets and decision systems.

Generative AI Solutions for Insurance Agents

The future of generative AI in insurance is still unclear, but if AI technology has proven anything, improvements are made in leaps and bounds.

Explainable AI

Explainable AI is a collection of tools seamlessly integrated into various Google products and services. By using Explainable AI, you can identify and rectify issues with your machine learning models and assist others in understanding how they operate.

Explainable AI can modify and improve insurance value because it’s:

- Transparent – Explainable AI breaks down decisions from a black box to explain how and why decisions are made, allowing insurers to detect and address potential biases in their models. More importantly, it provides the best explanations for each targeted audience.

- Traceable – Explainable AI allows users to understand how the logic and data contribute to insurance-based outputs.

- Still Human-centered – Explainable AI doesn’t replace humans and gives insurers the information they need to understand and improve the process.

Amelia

Amelia helps carriers and policyholders in policy administration, claims, and billing stages. Providing speedy and personalized services is challenging for carriers due to limited resources and high costs. Amelia utilizes her skills during customer interactions in carrier call centers and digital support channels.

Insurers can manage policies digitally; they can do this efficiently because Amelia:

- Recognizes Intent – Amelia is proficient in communicating with customers using local languages and deeply understands user intents and sentiments. In addition, Amelia makes it easier for customers to navigate their claim experience.

- Uses Escalation Appropriately – Policyholders can receive urgent assistance from Amelia, who is available 24/7 in an emergency or accident. Amelia also promptly connects customers with human agents.

- Tracks Analytics – Amelia monitors customer behavior and evaluates insurance service effectiveness, providing enhancements and identifying opportunities for product expansion.

The use of AI is a changing business landscape and how customers communicate with insurance companies. Read their white paper for more information on Amelia’s effects on insurance.

Final Thoughts

Generative AI has the potential to revolutionize the insurance industry, improving the outputs of the insurance value chain. Though risks are involved, current artificial intelligence solutions provide transparency for insurers, allowing them to address critical questions to determine their course of action.

- What are the needs of our customers, and are we addressing them?

- Would using generative AI be sufficient to solve the problem, or does it require other technologies to be combined with it?

Many top companies have begun implementing generative AI in their systems, allowing them to increase innovation and provide better customer service. In today’s competitive market, insurers must use what tools they can to stay at the forefront of innovation and technology.